Table of Contents

Introduction

When you think of investment, question arises which gives better returns Bitcoin or Gold. This confusion is there with most of investors when they plan to invest for future. In this article we will be exploring how bitcoin and gold as an investment instrument has performed in past 5 years to give you an holistic idea what you can expect in terms of return for your investment.

Let’s First Understand better returns Bitcoin or Gold

Gold:

Within the Earth’s bosom lies a commodity, extracted and revered as a precious metal — Gold. Its mining and presence in global markets span countless centuries, and across generations, humans have regarded it not merely as a form of currency but as a secure instrument for investment.

Among the crowded market of investment advice and investment advisors, most of them will be advocating for the inclusion of gold in the investment portfolio.

Gold has earned its stripes as the epitome of stability in the realm of investments. If you are of the thought process that while holding gold for a short span of a few years you would be amassing huge wealth due to the appreciation of Gold prices. It may not yield boundless joy, but its resilience shines through in times of instability.

In contrast to other investment avenues tethered to external forces, such as the stock market, currency, or cryptocurrencies, gold stands unyielding in the face of adverse global situations — be it war, pandemic, or natural disaster.

In such turbulent times, this battle-hardened commodity emerges unscathed, offering not only stability but also modest yet significant returns.

Above all, in moments demanding swift financial maneuvers, gold proves effortlessly tradable. Its liquidity extends seamlessly across stock markets and traditional secondary markets, providing a lifeline in times of urgent financial requirements.

Gold’s allure lies not only in its status as a precious metal but also in its ability to weather the storms of global instability, offering a refuge for those seeking both stability and liquidity in their investment ventures.

.

Bitcoin:

In the realm of digital finance, one name that resonates universally is Bitcoin, the flagship cryptocurrency. Anyone who is thinking of investing would have heard about Bitcoin as an instrument of investment these days.

Delving into the essence of cryptocurrency reveals a paradigm shift—an intangible currency not minted or regulated by central authorities but meticulously extracted through the intricate workings of a computer network.

This network of computational entities operates on specialized algorithms within a cryptographic structure known as the blockchain. Upon successfully unravelling the intricate puzzles embedded in this blockchain, a cryptocurrency emerges as a reward.

Bitcoin, is a digital cryptocurrency, which is cultivated through the resolution of formidable challenges on a safe, secure, and stable blockchain. Bitcoin is makings its name in past 8-10 years as a investment asset which could yield high returns over some time.

Technological strides and widespread acceptance of cryptocurrency within people, financial institutions and even certain governments have propelled Bitcoin into the limelight as a viable investment avenue. Bitcoin distinguishes itself as a trailblazer, commanding the largest market capitalization in the crypto domain.

Beyond its symbolic leadership, Bitcoin stands out as a remarkably liquid asset. The market perpetually teems with buyers and sellers poised to engage in transactions involving this pioneering digital currency. Bitcoin not only holds historical significance but also embodies the epitome of liquidity and leadership, shaping the narrative of the digital financial frontier.

Now Let’s Understand Which gives better returns Bitcoin or Gold as Investment Instrument:

For this we have taken few considerations:

- Data for evaluating bitcoin and gold performance is taken from Investing.com leading website for financial data.

- Time frame for evaluation is of 2 types. One is short duration of 1 year and long duration of 5 years for comparison of return on investment in Bitcoin and Gold.

- Comparison is solely for understanding how as investment assets both have return returns and one should do its own research before doing any investment.

Bitcoin: Key Data Points

- The price of Bitcoin on 1st Jan 2019 was 3437 USD.

- The price of Bitcoin on 1st Jan 2023 was 23125 USD.

- The price of Bitcoin on 20th Dec 2023 was 43662 USD.

| Time Period | Price of Bitcoin (USD) |

|---|---|

| 1st Jan 2019 | 3437 |

| 1st Jan 2023 | 23125 |

| 22nd Dec 2023 | 43662 |

Gold: Key Data Points

- The price of Gold on 1st Jan 2019 was 1331.6 USD.

- The price of Gold on 1st Jan 2023 was 1962.2 USD.

- The price of Gold on 20th Dec 2023 was 2047.7 USD.

| Time Period | Price of Gold (USD) |

|---|---|

| 1st Jan 2019 | 1331.6 |

| 1st Jan 2023 | 1962.2 |

| 22nd Dec 2023 | 2047.7 |

Let’s see Price Movement of Bitcoin and Gold on chart during 1& 5 Year respectively.

Price Movement: Better returns Bitcoin or Gold

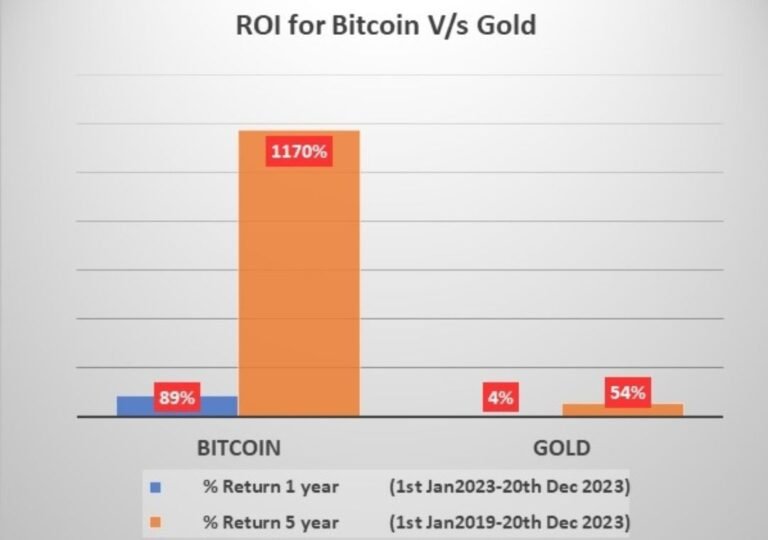

Return on investment ROI : Better returns Bitcoin or Gold

Key Results from analysis: Better returns Bitcoin or Gold

- Bitcoin is surely the winner when it comes in terms of price evaluation and ROI compared to Gold.

- We See in terms of ROI Bitcoin returned 89% return on investment for a short duration of 1 year and 1170% ROI for a longer duration of the past 5 years.

- Gold gave an ROI of 4% for a 1-year short-duration investment and of 54% ROI for a long time duration of 5 years.

Final Result of comparing Bitcoin v/s Gold

- Bitcoin cryptocurrency is a winner in terms of price and ROI for both 1-year and 5-year time frame compared to Gold.

- As we all know Gold as an investment instrument has been there for past many centuries whereas Bitcoin has come into existence in the last decade. Thus, one should take into consideration stability and long duration of existence as a consideration while investing.

- As an investor, one should be investing only that amount of money in Bitcoin which he/she is ready to lose it without affecting their life. That is, one should only invest the amount which one is ready to lose as we are not sure for how many years or decades will bitcoin be there in the world of the financial market compared to gold.

- When allocating funds invest only a small share or percentage of your total amount for investment in Bitcoin. For sure you can expect a far greater return on investment in bitcoin compared to gold. But it’s also a fact you can expect small but a stable return on investment in gold but there is no guarantee you would expect the same results from Bitcoin.

- What you are return you are looking for in your investment and for how long do you want to invest your money? One should be clear while going for investment. Both Gold and Bitcoin are highly liquid assets and give good returns. Bitcoin comes as a risky asset while gold is a safe asset so make your own choice as per your financial objectives.

Conclusion

What you learn from the study is which gives better returns Bitcoin or Gold and the answer is it depends on you what you are looking for from your investment. If you want to earn fast and high returns which comes with its risk then Bitcoin is your choice for investment.

And in case you want to have mental peace while making an investment where you are happy with a small but steady return then go for Gold.

If you are focusing on cryptocurrency for your investment then find out which cryptocurrency in 2023 gave good returns for investment.