Role of Artificial Intelligence in finance is critical and crucial role today. To understand this better, one first needs to understand finance. What is finance and how does it help businesses and individuals; understanding this will help one appreciate the nuances of the multiple applications of AI in the finance stream.

Table of Contents

- What is Finance?

- Now that we know the basics of finance, let’s learn about Artificial Intelligence

- How Artificial Intelligence is finding an increasing role in Finance?

- Conclusion

What is Finance?

Finance can be described as the management of one’s expenses, costs, sales, and money management as a whole. Understanding it can help one make crucial decisions on investments, sales & purchases. As well as management of tangible and intangible assets.

- Broadly, Finance can be divided into 3 primary streams: Personal Finance

- Corporate Finance

- Public Finance

Personal Finance

It is the management of individuals’ own money. Understanding one’s own earnings, expenses, investments, and future requirements and managing them effectively is crucial to fulfilling one’s life goals. Mismanagement or ineffective handling of one’s personal finance can result in bankruptcy and loan defaults. So, personal finance plays an invaluable role in one’s life.

Corporate Finance

It is the management of finance for businesses. Whether it is a corporation or a small family business, understanding and managing the financial needs of the organization is key to running a successful and profitable business. For example, when raising funds, the organization has to decide when to raise loans. Either through banks or equity or public institutions such as the stock exchange, based on business objectives. Similarly, decisions like when to invest in capital goods or expansion of branches in different geographical locations will depend on the availability and proper allocation of funds.

Any business entity that does not manage its finances systematically. That is by ensuring expenses are in control compared to sales and future goals. They run the risk of defaulting on their financial obligations. This could, in turn, lead to the company being taken over by a competitor or a financial institution. And in a worst-case scenario, the closure of the business.

Public Finance

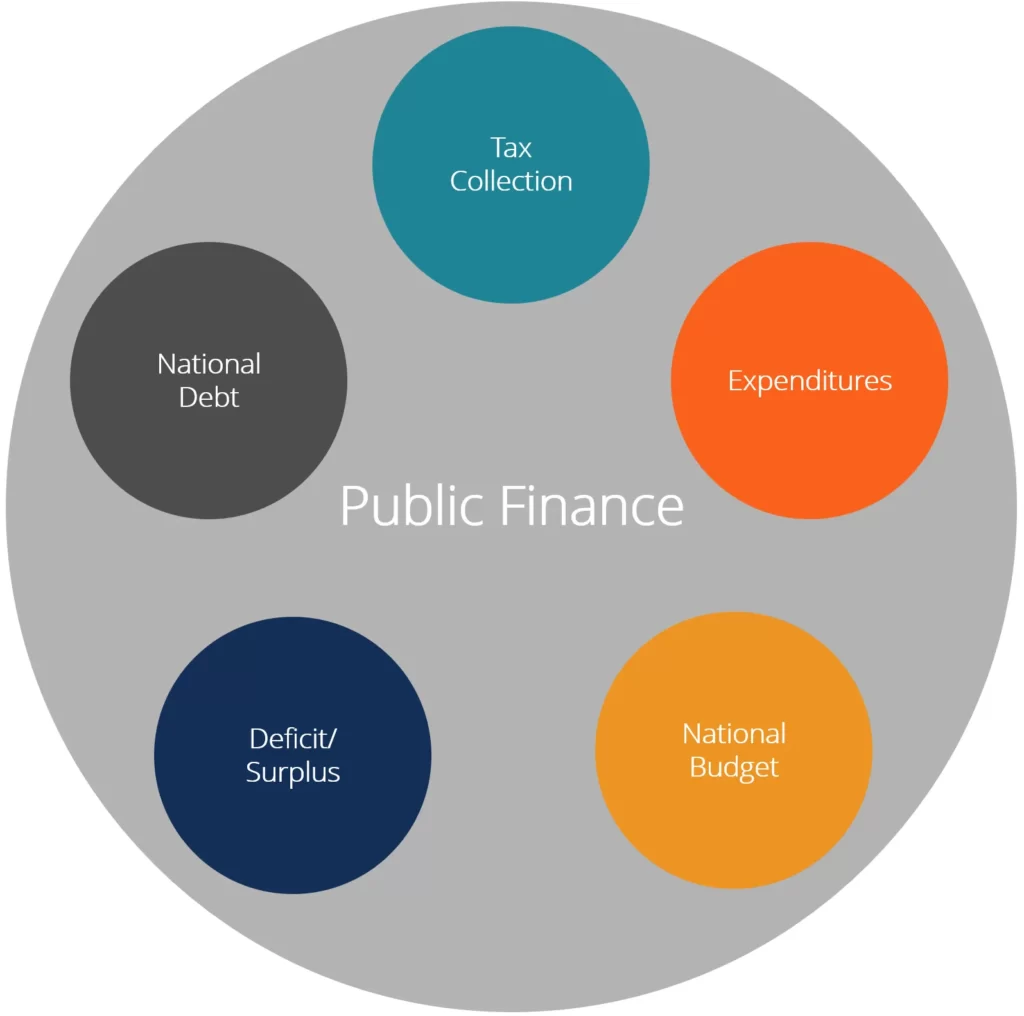

It is arguably the most important channel in finance. The well-being of a nation depends on how well it manages its public finance. A country’s economy will grow when the government in power manages its finances in a sustainable and long-lasting manner. Countries need to make critical decisions on the distribution and allocation of funds. This involves different sectors like education, public health, defence, and infrastructure.

It is a critical stream of finance. Institutions like central banks, public institutions, and sovereign wealth funds of nations have to ensure appropriate allocation of their resources. It is necessary to maintain the fiscal health of the nation. All streams, like public health, education, or defence, are important for the economy of the country to grow. And ineffective fiscal management can result in defaults. It will lead to financial meltdowns, public unrest or coups, or even wars with neighboring nations. Recent examples are the global financial meltdown of 2008, and 2019 covid crisis, and the wars in Iraq, Ukraine, Syria, etc.

Now that we know the basics of finance, let’s learn about Artificial Intelligence

AI is the science of using computers (single or a set of machines in sync together) to make intelligent decisions based on inputs provided to the system. Essentially, it can be defined as a computer program or algorithm, which when provided with a large set of input parameters, analyses them simultaneously, to arrive at the best possible scenarios. The decisions and outcomes that these AI programs arrive at, by analyzing large input data sets are not humanly possible as the human brain has limitations on the amount of information that it can learn, understand and comprehend.

These human limitations have led to the development of Artificial Intelligence as a science to overcome these obstacles. Thus, advancement in computing power with the emergence of efficient computer processors has enabled AI systems to analyze multiple Gigabytes and Terabytes of data sets in a short span of time to arrive at quick decisions.

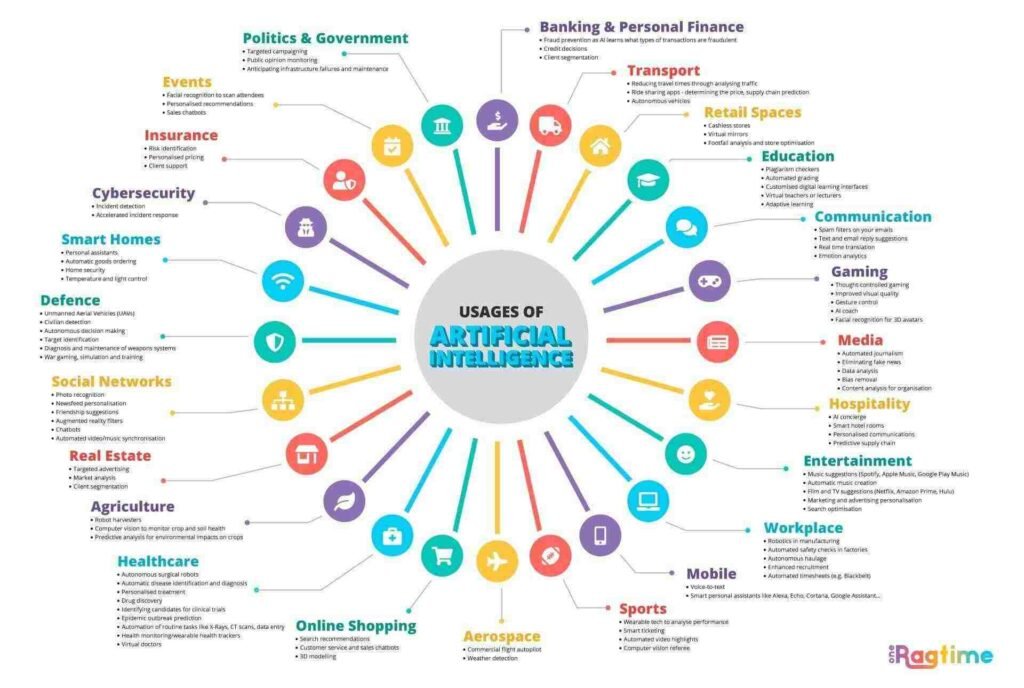

Artificial Intelligence is thus finding its way into a variety of industries ranging from food, retail, automobile, banking, public service, defence to aerospace. With every passing year, we are seeing AI enter virtually every sphere of human life.

How Artificial Intelligence is finding an increasing role in Finance?

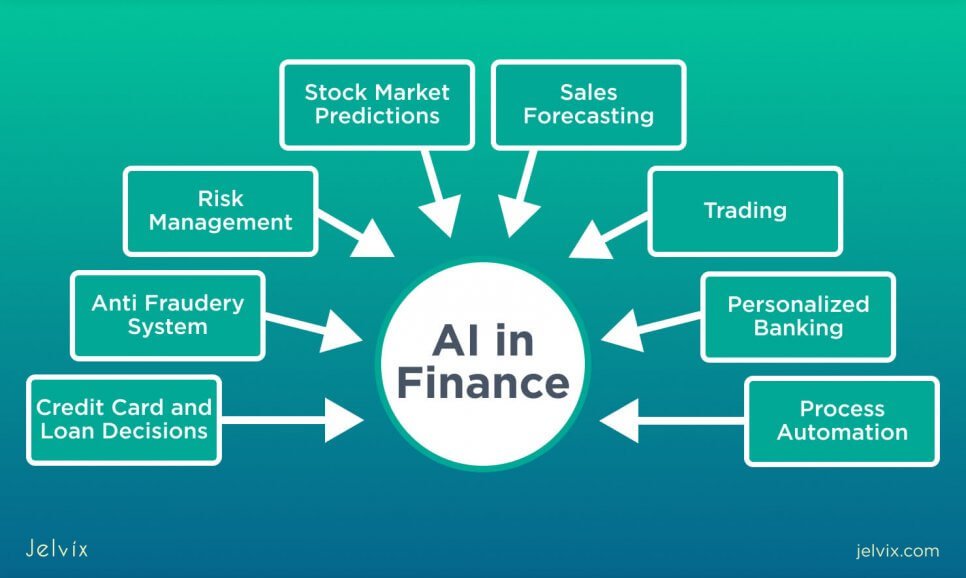

Now that we have understood both Finance and Artificial Intelligence, let’s take a look at how AI is finding multiple applications in Finance.

Role of AI in Personal Finance

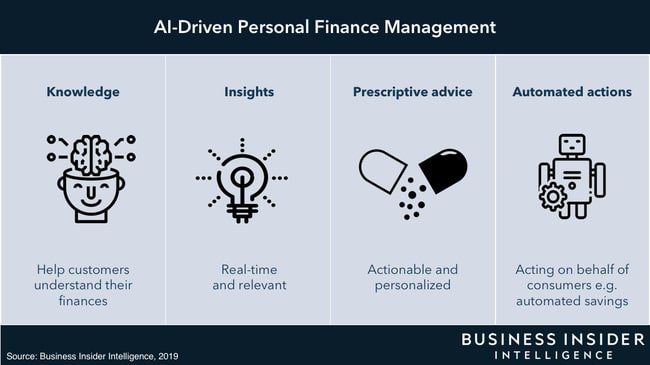

It displays an increasing role in personal finance by alerting users of their financial expenditure patterns. Also predicting when they may need more liquidity or face a liquidity crunch. It is helping users decide on the financial instruments to invest in, be it bonds, government securities, stocks, or fixed deposits in banks. These AI-driven decisions help individuals mitigate and distribute their risk over multiple financial instruments. Algorithmic trading uses AI to help users place their bets in financial markets. With predefined risk appetite, thus increasing the chances of them getting rich dividends, as these models make analysis and data-based decisions to buy or sell without any human emotions.

Similar applications can be seen in the insurance industry, where AI can help users make decisions on choosing the right financial instrument by analyzing a large set of predictable and unpredictable situations that a human mind cannot process.

AI-based financial apps can analyze spending trends and then suggest activities and habits that one must increase or decrease for better financial prudence. Such apps can be a boon for many individuals who would otherwise struggle to plan for their future.

How AI in Corporate Finance helps

Artificial intelligence is helping many corporations revamp their business processes to be leaner and more efficient to help them compete in an ever-changing business environment. Large enterprises have huge amounts of data being collected at various stages of their business cycle, they require machine programs to analyze them. Here, AI programs help these corporations understand and comprehend these huge data sets and arrive at decisions that are more beneficial for their businesses.

In the banking industry, it is humanly impossible for loan managers to predict when an individual or entity may fail to fulfill their obligations like loan repayments. AI comes in handy here, helping banks and financial institutes get a holistic profile of their customers and suggest the products that should be offered to these customers without increasing their risk appetitive.

Use case of AI in Human resource

Another example of AI can be seen in Human Resources. Here, AI models can help devise and structure payment plans that should be offered to their workforce. This would be based on their capabilities, industry trends, and benchmarks. Similarly, AI can help identify workstreams that are highly critical or drive high business impacts. And those which can be made redundant without impacting business. These use cases of AI can provide a moral dilemma, as it can be seen in violation of basic human values and principles.

AI in corporate finance helps businesses make decisions based not only on present requirements but also based on future requirements. For instance, AI can help corporations decide between investing their resources in capital goods expansion, human resources, or revamping their product offerings. These are based on business priorities and expected outcomes.

AI is in the banking and insurance industries in order to identify the right set of customers to target based on their financial profiles. It helps banks identify such customers by analyzing their financial history. Thereby predicting their probability of default so that banks can onboard customers with lower default risk. Credit scores provided by various rating agencies are also examples of AI applications. For example, the CIBIL score in India is based on computer models which take into account many parameters of customers to generate a profile and a credit score. This is then used by banks and financial institutions to make decisions on loan eligibility.

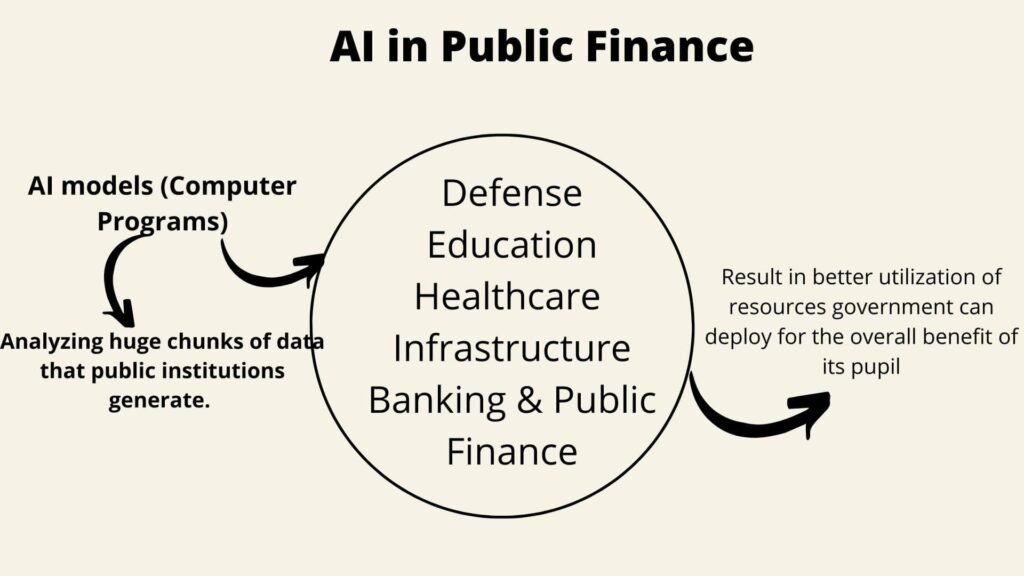

Application of AI in Public Finance

Artificial intelligence is playing a vital role in public finance. It helps governments take effective decisions to reduce irregular financial activities and provide better services to their citizens. Helping agencies to monitor and find anomalies. Which could be in the financial expenditure of its various arms, enabling them to keep track of spending.

Through AI models, public institutions are able to analyze macroeconomic data like GDP, national income, and inflation. It also analyses consumer price index, interest rates, etc, and predicts their impact on the country’s economic stability. Through this analysis, AI can also help direct resources to the appropriate areas. Which in turn helps to alleviate poverty levels and bring more widespread economic prosperity to the country’s citizens.

AI in Public health

AI is also helping public health agencies utilize their resources more effectively by helping with decisions on deploying resources at primary healthcare centers in remote parts of the country, and also simultaneously developing advanced systems in cities to cope with huge health challenges like COVID-19 recently. Artificial intelligence can help predict population segments, based on age group, ethnicity, race, etc, that might require medical aid in current and future times, thus helping agencies allocate their resources optimally to cope with medical emergencies such as pandemics and other health crises.

Artificial intelligence in Education

Another example of AI is in the education sector. Where it is helping to revolutionize education. Through the development of tools and techniques to provide quality education to a larger population. These models are equipping public agencies with skill sets. Thus helping them focus and develop education programs specifically catering to those skill sets. These programs are also helping spread the reach of education to the weakest sections of the population of the country. Thus helping to educate people in far-flung areas of the country through future-ready mobile-driven education models.

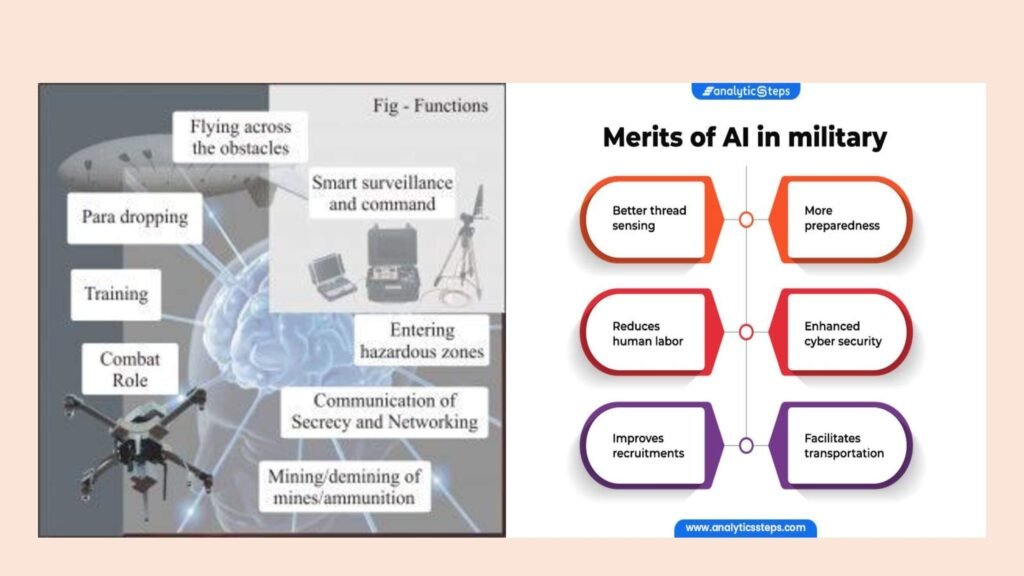

Use of AI in Defence

AI in defence has expanded rapidly. Public agencies are using these AI techniques to profile the population to identify potential threats to national security. AI models are able to predict enemy force movements. And providing strategic information to decision-makers to mobilize troops in case of hostilities. It is helping in developing missile defence systems. That can identify and neutralize potential missile attacks. Before they can strike the intended target by analyzing various parameters like distance, payload, speed of travel, etc. Cyber-attacks generated by AI programs or computer models can be used to cripple enemy systems through communication channels, information warfare, mobility hurdles like the failure of radar systems, etc. With so many uses case of AI in the defence sector, countries can maintain a balance between global and domestic security. Also, be prepared for future possibilities of confrontation.

Conclusion

Artificial Intelligence is increasingly being used in Finance and is revolutionizing the Finance industry in ways that were unthinkable a decade back. With increased advancements in computer systems and models, AI will continue to evolve and help mankind mitigate multiple risks and be future-ready to tackle any unknown challenges that might be thrown their way in the future.

Now you know how AI is playing its role in finance you may be interested to know how AI is used in Investment Banking Industry

A fascinating discussion is definitely worth

comment. I do believe that you ought to publish more about this subject,

it might not be a taboo matter but generally people do not talk about

these subjects. To the next! Best wishes!!

Hi ,

Yes i agree with you that we need to produce more on this field and open discussion that AI is not something to be afraid off but its going to help humans is every sphere of their work.

Cheers !! we will surely update you when we produce new in this field .

Pingback: Artificial Intelligence in Investment Banking - Techaninfo

Hey there! I simply want to give you a big thumbs up for the excellent information you have here on this post. I am coming back to your website for more soon.

Thanks for your encourgament. we will surely write more informative articles in the space of AI which can help each other to learn more about innovations and improvement happening in AI !